ANALYTICS XL is a Microsoft Excel add-in program that includes Discount for Lack of Marketability and Total Shareholder Return Valuation

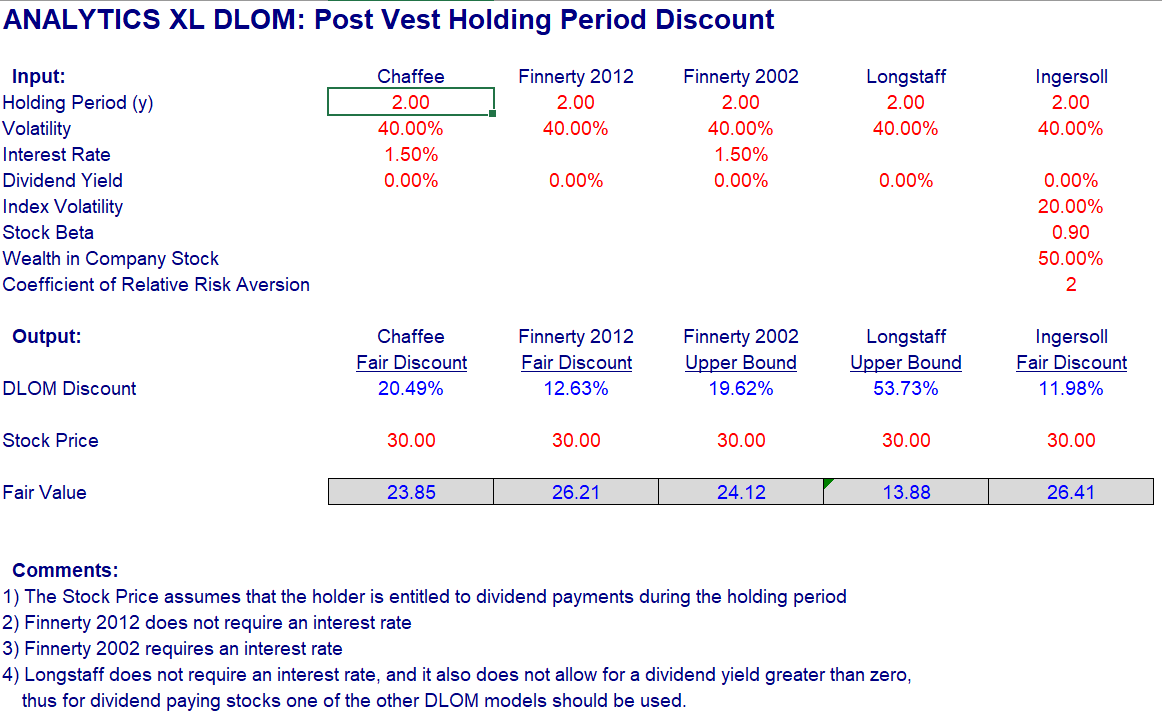

DLOM Functions

- Finnerty 2012 The Finnerty Average-Strike Put Option (2012) model to calculate the Discount for Lack of Marketability (DLOM)

- Finnerty 2002 The Finnerty Average-Strike Put Option (2002) model to calculate the Discount for Lack of Marketability (DLOM)

- Longstaff The Longstaff model provides an estimate of the DLOM assuming the seller of the shares has perfect market knowledge, and is able to time his sale to maximize the proceeds.

- Ingersoll The Ingersoll model for calculating the Discount for Lack of Marketability (DLOM) is based on financial theory that includes elements from option pricing and economic utility frameworks. It is designed to evaluate the DLOM by considering the illiquidity of an asset and the market variables that affect its price.

- Chaffee The Chaffee Model, also known as the “European Put Option Model,” estimates the DLOM as the value of a European-style put option on the common shares with a strike price equal to the share price on the valuation date.

MITI White Paper: Theoretical Models for Discount for Lack of Marketability (DLOM)

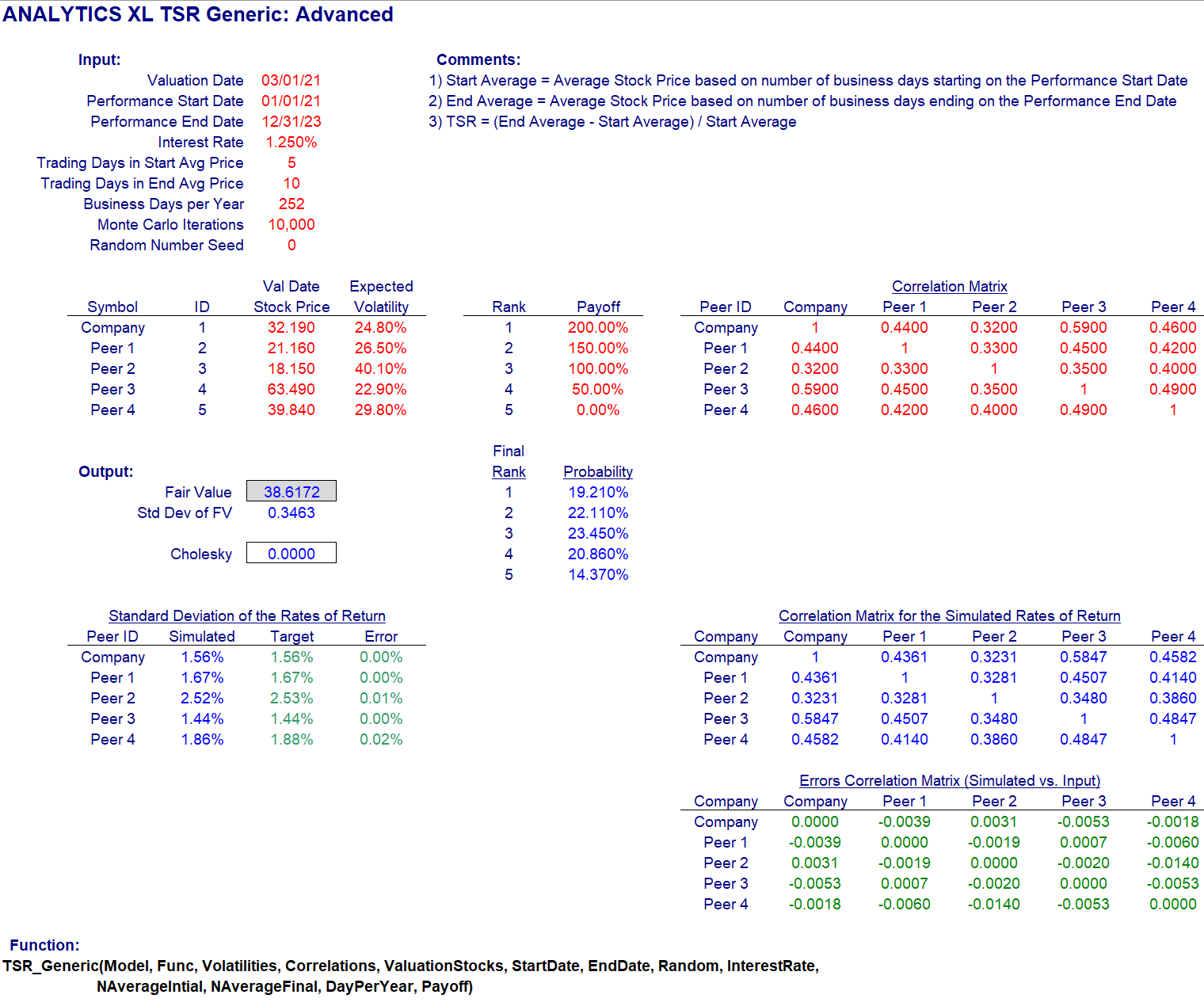

Total Shareholder Return (TSR)

MITI White Paper: Introduction to TSR