BONDS XL is a Microsoft Excel add-in program that allows you to value fixed income securities.

This add-in provides a complete set of calculations for US and international fixed income traders, portfolio managers and analysts.

BONDS XL is Security Industry Association (SIA) compliant.

- Bonds

- Treasuries: Actual/Actual

- Zeros: Treasury strips

- Agencies: 30/360, with adjustments for conventions

- Corporates: 30/360, with adjustments for conventions

- Municipals: 30/360, with adjustments for conventions

- Callables: Callable, at a premium or discount

- Odd Coupon: Long or short first/last coupon periods

- Euro Bonds: 30e/360, 1 or 2 coupons

- Bonds Analytics: Standard Securities Calculation Methods

- Money Market

- Bills: Act/360, discounted securities

- BAs: Act/360, discounted securities

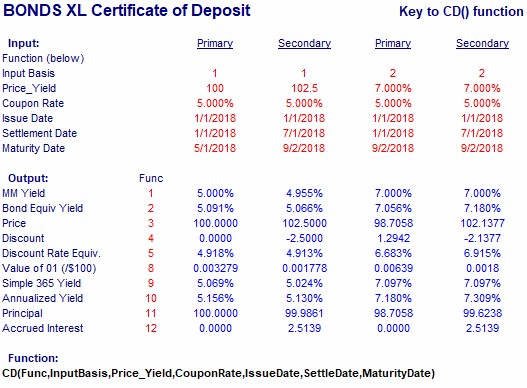

- CDs: Interest at maturity securities

- Custom Series

- Bond Futures: Conversion, cheapest-to-deliver, implied repo

- Stepped Coupon: Variable Coupon Bonds, Brady Bonds

- Convertible Bonds: Analytic, Vasicek, and Cox-Ingersol-Ross methods

- Bonds Array & Call Put Schedule: Array Output of Bond functions.

Values Bonds on call and put dates

- Bonds IAM: Bonds Interest at Maturity

Functions

Bond functions include Yield to

Maturity, Price given Yield, Accrued Interest, Duration, Convexity, Yield

to Call, Coupons to Maturity, Value of an 01, Bond

Futures Basis, Cheapest-to-Deliver, Implied Repo Rate and many more.

Calculations conform to Industry Standard including SIA and MSRB.

Bonds Calculator

BONDS XL Calculator

Cash Bond Options

Contact MITI for more information

Bond Futures Options

See OPTIONS XL