EXOTICS XL is a Microsoft Excel add-in program that allows you to value non-standard option and derivative contracts.

The types of contracts that may be valued using EXOTICS XL are Average Price and Rate

(“Asian”), Barrier (“knockouts and knockins”), Binary, Chooser,

Compound, Currency-Translated, Lookback, Portfolio, Rainbow and Spread options.

To achieve the company’s goal of remaining at the leading edge of option and

derivative analytics, Montgomery Investment Technology, Inc. will develop new

functions and pricing models to meet market demand. Specialty applications and

functions can be created on a custom basis to meet your in-house needs.

- Non-Standard Options

- Average: Average Price/Rate (“Asian”) and Strike

- Barrier: Knock-out/knock-in with rebate capability

- Binary: Binary Barrier, All-Or-None and Gap

- Chooser: Option to choose a call or put in the future

- Compound: Option to buy an option in the future

- Currency-Translated: FX Translated Options, “Quanto”

- Lookback: Option exercise determined by Min / Max price

- Portfolio: Option on portfolio of two assets

- Rainbow: Option on minimum or maximum of two assets

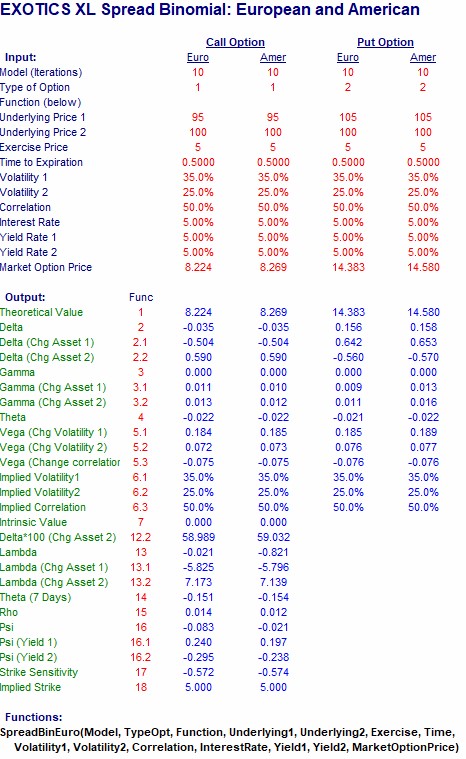

- Spread: Option on 2 asset spread (e.g. “Crack” or “Spark”)

- Custom Series

- Double-Barrier: American and European-style knock-out/knock-in options with rebate (binomial)

- Double-Barrier Flexible: American and European-style knock-out/knock-in options with rebate (flexible

- binomial)

- Monte Carlo: Methods Average, Barrier, Lookback, Standard contracts

- Implied Binomial Tree: Based on research by Goldman (Derman) or Rubinstein (UC Berkeley)

- Finite Difference: Finite Difference

- Cash Bond Options

- Modified Black-Scholes: Price-diffusion for short-term options

- Cox-Ross-Rubinstein: Price-diffusion for short-term options

- Rendleman and Bartter: Yield-diffusion for short- to long-term options

- Hull-White: Yield-diffusion for long-term options with mean reversion

Schedule your free FinTools XL live demo today.