OPTIONS XL is a Microsoft Excel add-in program that allows you to value options on stocks, foreign exchange, futures, fixed income securities, indices, commodities and Employee Stock Options (ESOs) using custom functions.

Market data from your quote vendor can be automatically passed to the custom functions.

Some of the ways that OPTIONS XL may be used are:

- Valuing option contracts on various assets including stocks, foreign exchange, futures, fixed income securities, indices and commodities

- Valuing employee stock options (ESOs) in accordance with ASC 718 of the Financial Accounting Standards Board

- Track portfolio positions in real-time (using data links from your quote vendor), including sensitivities such as delta, gamma, theta, vega, rho, psi and lambda

- Real options for capital budgeting

- Calculate implied volatility values based on the prices of exchange traded options

- Option pricing under Non-Normality using Gram-Charlier

- Valuation of SPAC Warrants with up-and-out barrier feature using Monte Carlo Simulation

OPTIONS XL is ASC 718, IFRS 2, and SEC compliant for fair value accounting purposes.

- Premium Series

- Black-Scholes: Non-dividend paying equities (the original)

- Black: Futures (financials, energy, FX, commodities)

- Garman-Kohlhagen: Spot foreign exchange

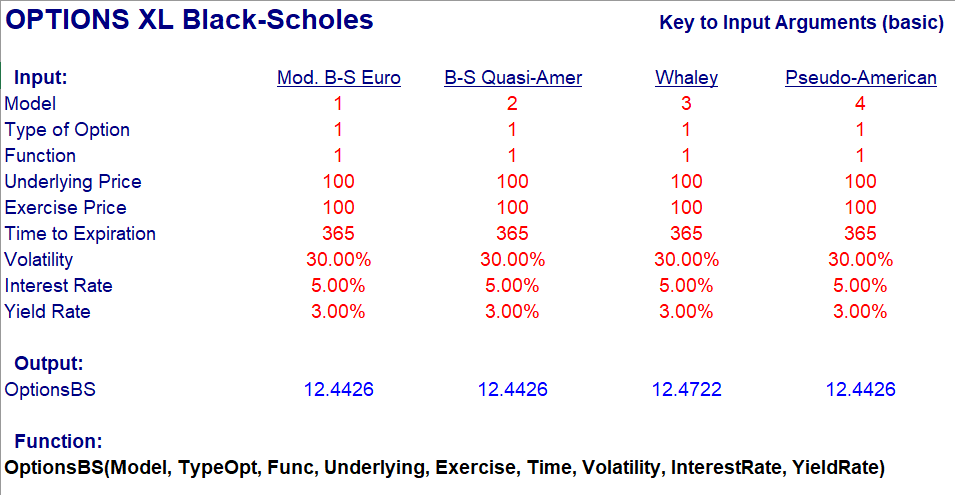

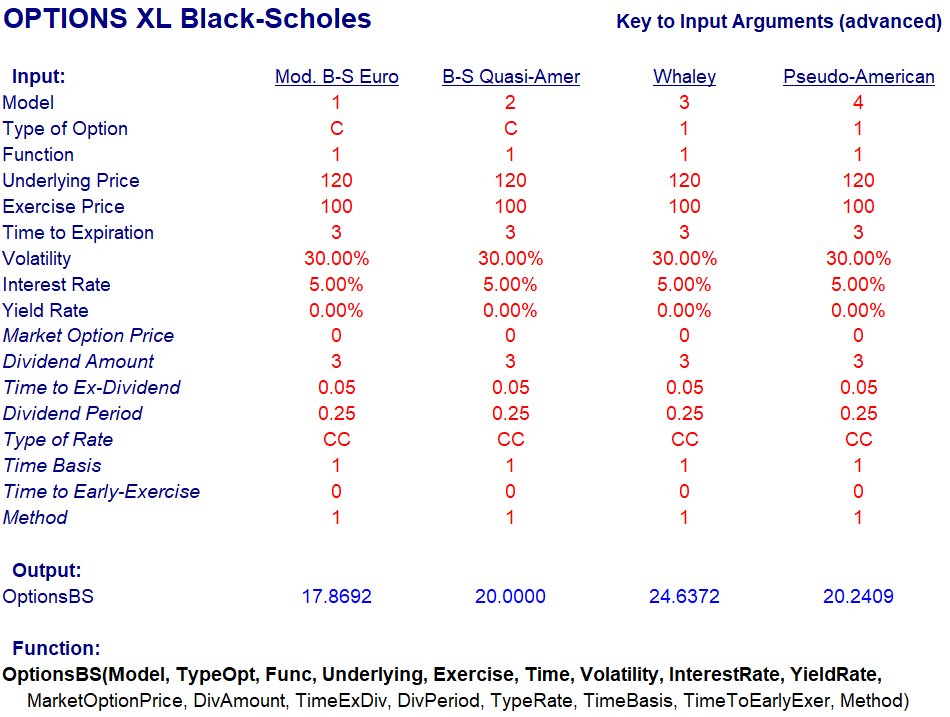

- Modified Black-Scholes: Dividend yield input (equities, indices, bonds)

- Whaley: Assets with a continuous yield Values American-style early-exercise

- Eurodollar: Eurodollar and bill futures optionsBlack-Scholes, Whaley and Binomial

- Pseudo-American(B-S): Dividend paying equities, discrete dividends nearest-dividend dates

- B-S French: Black-Scholes model modified to handle trading days\

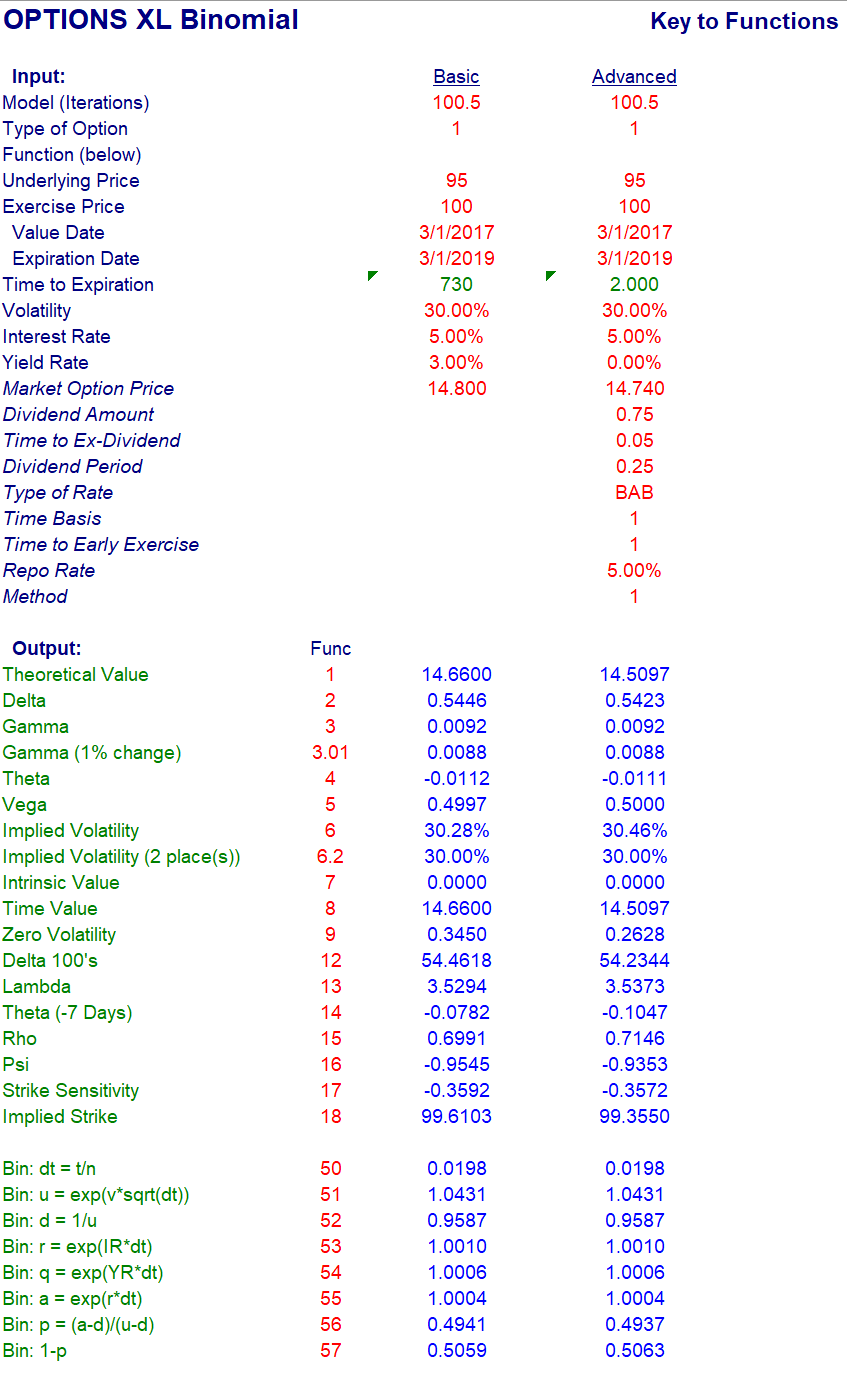

- Binomial(C-R-R and Hull Methods): Assets generating discrete cash flows (dividends)Full early exercise considerationDiscrete cash flows or yield inputAmerican, European and Bermuda style exercise

- Flexible Binomial Series

- Flexible Binomial(C-R-R and Hull Methods): Flexible input of key option variablesDiscrete cash flows or yield inputMultiple interest rates (yield curve, forward curve)Changes in yield over time, dilution effectsAmerican, European and Bermuda style exerciseIdeal for Warrants, Index Options, OTC Options, ESOs

- Custom Models

- Method of Lines(Carr): An efficient, accurate analytical valuation of American-style options. Based on the work of Peter Carr, formerly of Cornell University.

- Jump-Diffusion: The Jump-Diffusion method assumes that asset price changes do not follow a pure random process but also contain an unexpected “jump” component.

- CEV: Constant Elasticity of Variance model calculates option values based on non-constant volatility assumptions.

- Forward Start: Options that have a start date in the future based on “moneyness” ratio.

- Portfolio Optimization: Option Portfolio Optimization of OEX and stock option contracts.

- Real Options: Real Options and Capital Project analysis using option pricing theory.

- Gram-Charlier: Calculates option values for returns that do not follow the normal distribution.

- Options Exercise Behavior: Calculates option values considering the employee exercise behavior using Monte Carlo simulation.

- Option Lattice: Calculates the values of American-style options using several lattice or tree methods. Binomial, Enhanced Binomial and Trinomial techniques are included in this set.

Functions

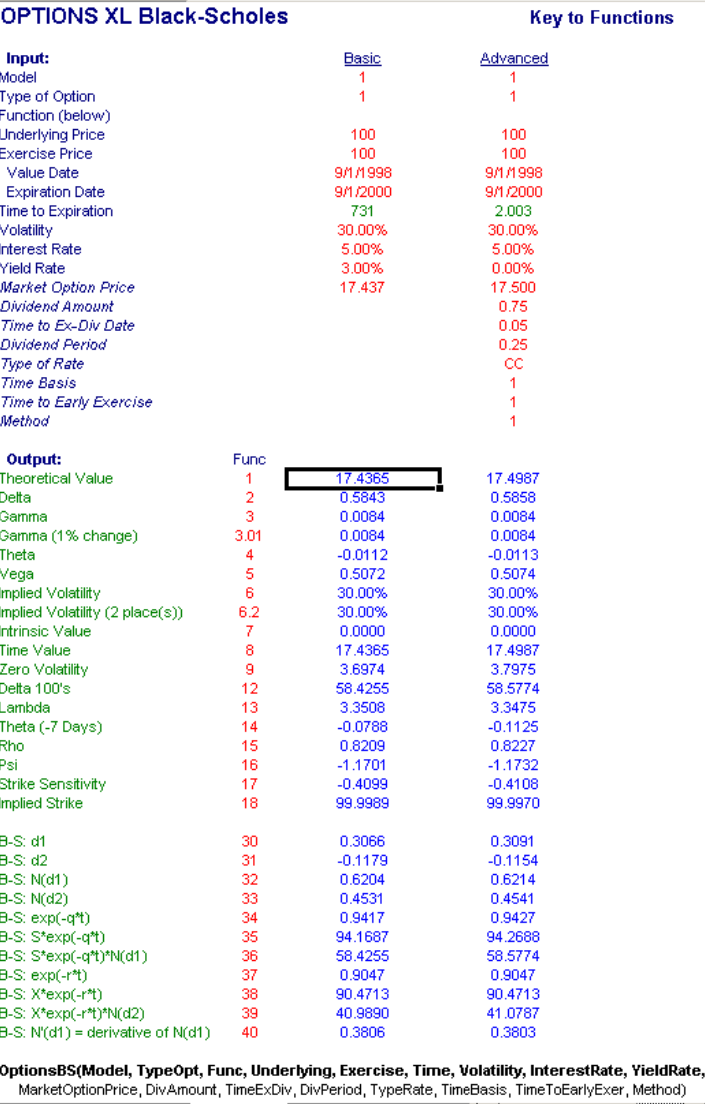

Options functions include Theoretical Value, Delta, Gamma, Theta, Vega, Rho, Psi, Lambda, Intrinsic Value, Implied Volatility and many more.

Recalculation speedup using Function Array and Strike Grid functions.

Templates

Standard Templates:

- 3-D Charting

- Black-Scholes Illustrated

- Binomial Tree Illustrated

- Sensitivity Matrix

- Nymex “Option and Futures Strategies”

- John Hull “Options, Futures and Other Derivative Securities” book examples

Specialized Templates:

- Fair Value Sheets: Trading sheets template for market-makers and traders

FAS123 Toolkit

Employee stock option valuation: Share-based Payment Navigator, FAS123

Wizard, Volatility Wizard,

Peer Group Volatility, Flexible Monte Carlo Exercise Behaviour and more

Option Position Analysis

Option Position Analysis: Futures, Equities, Foreign Exchange, and Options Positions

Option Position Analysis Real-Time: Equity and Option Positions