FAS 123R Standard

Factors to consider in estimating expected volatility include:

- Volatility of the share price…

- The implied volatility of the share price…

- A newly public entity also might consider the expected volatility of similar entities. A nonpublic entity might base its expected volatility on the expected volatilities of entities that are similar except for having publicly traded securities.

- Appropriate and regular intervals for price observations…

- Corporate and capital structure. An entity’s corporate structure may affect expected volatility…

– FAS 123R paragraph A32

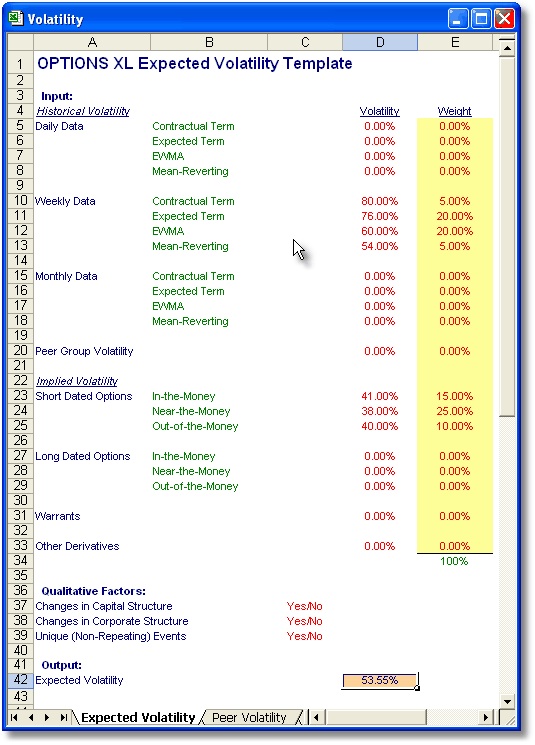

MITI Solution

MITI can summarize the calculated volatilities into an Expected Volatility Template and work with the client to determine the appropriate weights to apply to these volatilities.