FAS 123R Standard

Unique Periods of High Volatility: “in computing historical volatility, an entity might disregard an identifiable period of time in which its share price was extraordinarily volatile because of a failed takeover bid if a similar event is not expected to recur during the expected or contractual term. If an entity’s share price was extremely volatile for an identifiable period of time, for instance, due to a general market decline, that entity might place less weight on its volatility during that period of time because of possible mean reversion.”

FAS 123R paragraph A32

MITI Solution

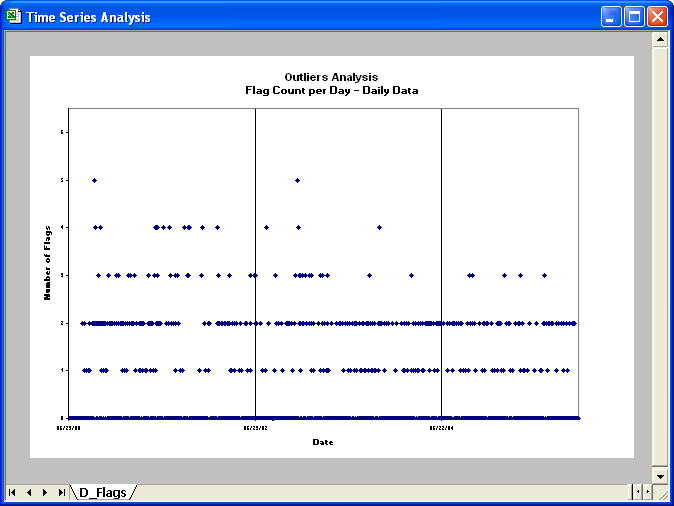

MITI provides a Time Series Analysis that uses a series of statistical deviation tests to identify time periods in which the share price was extraordinarily volatile. Time periods identified as unique may be deemphasized by applying a discount factor, thereby adjusting the historical volatility.